Have you done any improvements on your Hanahan, South Carolina, home this year? When filing your 2016 taxes, don’t miss out on your opportunity to get tax credits for any upgrades to your home. Home improvements increase comfort, energy savings, and the value of your home. The added advantage of saving on your taxes at both the state and federal level make those upgrades worthwhile.

Solar Energy Systems

Get tax credits at the federal level for solar energy systems. Through 2019, you can get a 30 percent tax credit on the cost of your solar energy system. This tax credit is good for principal residences and second homes. It doesn’t work on your rental properties, however. It is also good for both existing dwellings and new house constructions. The federal government has not placed an upper limit on the cost of installing the solar energy system, so you’ll get 30 percent whether you spend $500, $15,000, or more.

In 2020, that tax credit drops to 26 percent, and in 2021 the credit drops to 22 percent. It expires at the end of 2021, so you should act within the next few years if you want to install solar energy systems.

Solar energy systems and hydropower systems (like hydropower water heaters) that were installed after 2009 qualify for the South Carolina tax credit. The tax credit is 25 percent, as long as the credit amount doesn’t exceed $3,500.

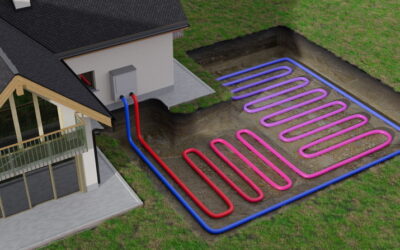

Geothermal Heat Pumps

Did you install a geothermal heat pump this year? The federal government offers the same tax credit for geothermal heat pumps that it does for solar energy. That is, 30 percent of the cost with no upper limit, which qualifies on primary residences, secondary residences, and new constructions. The only difference is that the geothermal tax credit expires at the end of 2016.

If you haven’t gotten around to installing a geothermal heat pump this year, don’t fret. South Carolina signed a geothermal tax credit into law earlier this year. The state tax credit is for 25 percent of the cost of your geothermal system, up to a $3,500 credit. However, if the credit would exceed $3,500, you can keep adding credits to your tax returns year after year until you’ve recouped the entire 25 percent!

It applies to anything installed after January 1, 2016, and thankfully doesn’t expire until January 1, 2019. You still have a few years left to get a geothermal tax credit in South Carolina!

Insulation and Other Incentives

Did you do any insulation work, caulking, or roof work this year? Did we install an air-source heat pump for you? You can take advantage of a tax credit that expires at the end of 2016 for this kind of work. It’s smaller than the credits available for solar and geothermal, but any tax credit is worthwhile. Get a 10 percent credit from the federal government for any costs up to $500 on this kind of energy-saving work.

Keep in mind that unlike the solar and geothermal credits, these smaller tax credits only qualify on primary residences. They don’t qualify for second homes or your rental properties. They also don’t qualify for new constructions.

The time is right for adding energy-efficient technology to your home. Even if some tax credits have expired by the time you get around to installing new equipment, the tax credits you do qualify for and the amount of energy you’ll save will be worth it. Plus, now is the time to invest in technology that will help to reduce the impact of our energy demands or waste products on the planet.

Have you been thinking about installing a geothermal heat pump? Berkeley’s qualified HVAC contractors and technicians will examine your yard and discuss your geothermal options. Call us soon at (843) 277-6030 before that South Carolina tax incentive expires, so you can get an even bigger monetary advantage from installing a geothermal system.

Image provided by Shutterstock